We are now a full month into the enforcement of Apple’s new App Tracking Transparency policy, which means we have a good chunk of data to analyze the impact on performance thus far. If you read my previous article on this topic, I was cautiously optimistic that the impact would not be horrendous, and I’m happy to report that the sky has not fallen!

Looking at Octane’s agency-wide data comparing May 2021 to April 2021, we are seeing a net reduction in reach of 11%. This is a good sign that we are not going to experience the doomsday level reduction in available reach as was predicted by some industry pundits prior to the ATT release. To add to this, we’ve seen a slight drop in CPM, while maintaining consistent data across most KPIs. Overall, the impact on performance has been minimal, and we are not seeing any major disruptions. The area we are seeing an impact is with on-site conversion reporting out of Facebook. With aggregated event measurement, fewer folks are being attributed to on-site conversion data on a 1:1 basis, hence a drop in tracking ability. That said, post click performance data through Google analytics points to similar, if not higher conversion rates post ATT enforcement for things like leads, VDPs, chat/text, etc. So, despite losing some conversion tracking granularity within Facebook, we are seeing consistent performance in Google Analytics.

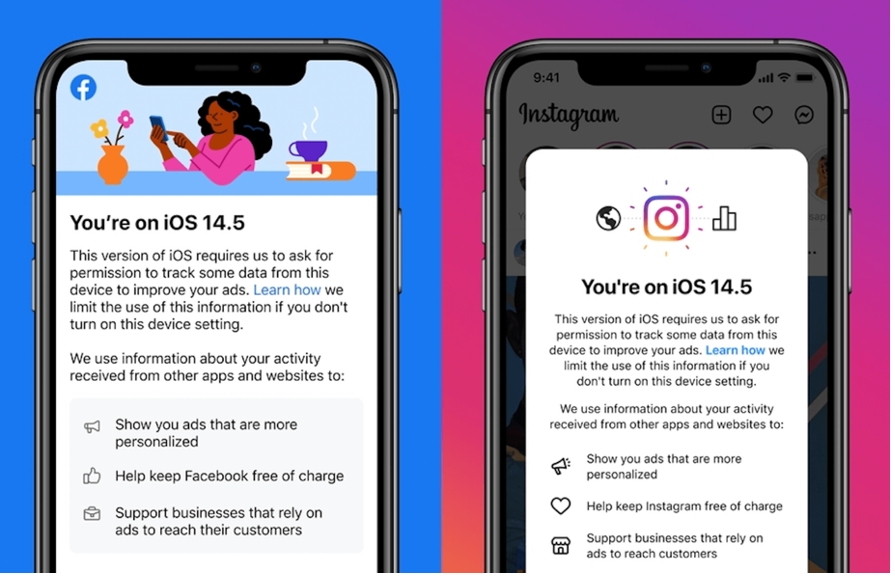

There have been many articles published over the past month fear mongering around the topic of opt-in rates once ATT enforcement began. Some sources claimed that in the US only 4% of users have opted in to allow app tracking across applications. This may very well be the case, but the data is very misleading considering that the studies do not break down the data by app. The reason this is an important distinction is because Facebook and Instagram did a good job educating their users on the importance of cross-application tracking to keep ads relevant, keep their app free of charge, etc. Below are the prompts both apps displayed to users right before they displayed the required Apple ATT prompt.

Based on the data we are seeing from of our campaigns since the ATT enforcement began, it is unlikely that only 4% of iOS 14.5 users opted in to allow tracking on the Facebook and Instagram applications. In the month of May 2021, mobile devices accounted for 92% of all advertising traffic, and iPhone made up 66% of that mobile traffic. This is a 2% increase in the overall mobile share of reach, and only 2% reduction in iPhone’s share of the mobile compared to Octane’s Q1 2021 data. That’s very encouraging considering all signals were pointing to severely diminished available reach for retargeting and 3rd party data driven initiatives for iPhone users within the Facebook walled garden.

I’ve said it before, and I’ll say it again: the value of advertising on Facebook and Instagram has not disappeared overnight with Apple’s ATT enforcement. Continue to watch your performance data and make strategic shifts into new targeting tactics and channels as needed, but as of June 2021, the outlook on Facebook advertising in the automotive industry is promising.